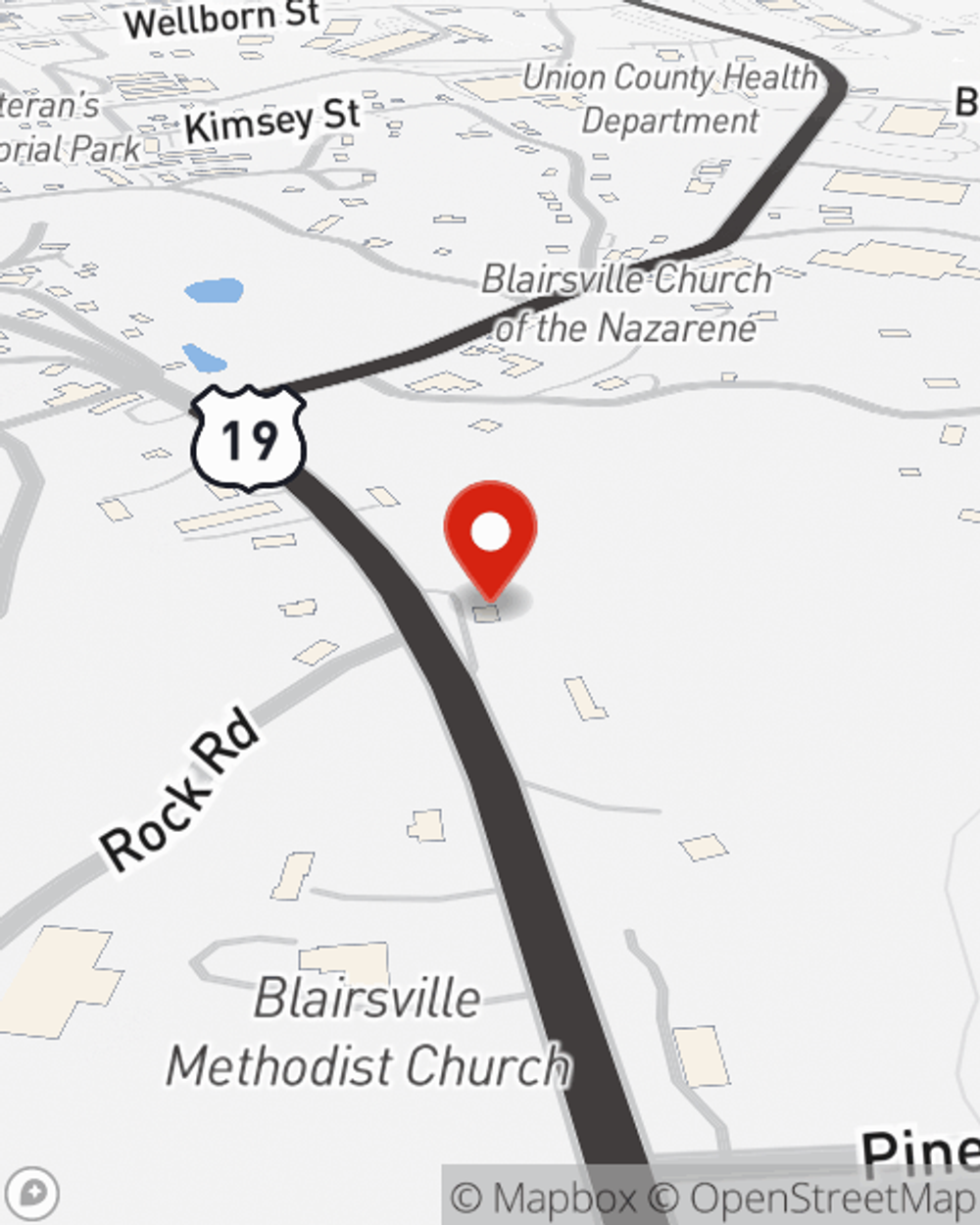

Life Insurance in and around Blairsville

Protection for those you care about

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Think you are too young for life insurance? Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Blairsville, GA, friends and neighbors of all ages already have State Farm life insurance!

Protection for those you care about

Don't delay your search for Life insurance

Agent Jeff Davis, At Your Service

Life can be just as fickle when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific number of years or level or flexible payments with coverage to last a lifetime, State Farm can help you choose the right policy for you.

As a value-driven provider of life insurance in Blairsville, GA, State Farm is ready to protect those you love most. Call State Farm agent Jeff Davis today and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Jeff at (706) 835-2886 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.